Receipts You Want For Doing All Of Your Taxes

In fact, you should maintain receipts for any tax deductions and credit. Since the IRS encourages you to keep records for so long, on-line storage becomes even more crucial. If you only keep paper receipts in a submitting cupboard, then you definitely risk losing them sooner or later. Should you ever get audited, you would find yourself struggling to offer evidence on your deductions. After submitting your taxes, it doesn’t mean you’ll be able to eliminate your receipts and paperwork. The CRA (Canada Income Agency) suggests maintaining these paperwork for six years after your last Notice of Evaluation.

For instance, if you buy a desk for your small business, the receipt on your desk would must be saved since you’ll find a way to write it off as a business expense. DIY tax prep saves cash but dangers errors, whereas skilled tax prep provides accuracy and peace of thoughts. Of course, receipts should also be organized by category and by date. For example, you might maintain your utility payments together, and so on. Most taxpayers won’t want to hold onto grocery receipts, but if any of the above deductions are ones you intend to take, maintain them to make sure you probably can back up your deductions. The IRS will permit you to declare the credit provided that you paid someone to allow you or your partner to work or discover work.

The holiday season usually means juggling family time, work, and childcare. If you’ve paid for childcare services to allow you (or your spouse) to work, a few of these prices might qualify for a tax credit. This applies to care offered to kids under thirteen or disabled dependents. Bills like daycare, after-school applications, and even summer season camps can depend towards this credit. And should you’ve used a vacation break as a chance to make amends for work, remember to save receipts for anything associated to your dependent’s care. In conclusion, proper record-keeping is significant for correct and compliant tax reporting.

What Receipts To Keep For Private Taxes?

Any digital natives you hire will respect being ready to submit bills proper within the app. As soon as they buy one thing with their company card, Fyle will text them, and so they can reply with a photo of their receipt for proof. Nonetheless, those who choose handling monetary errands on a desktop can ship in expenses utilizing Gmail, Outlook, Slack, or Microsoft Teams. Some are full-time freelancers who solely work with long-term clients, and some have a aspect hustle in addition to working a nine-to-five, however no matter what, they all need to track their expenses. To have a sense of their earnings, sure — but in addition to take benefit of tax write-offs. If you moved for work or faculty reasons, your transferring bills are deductible.

- Do you should maintain a receipt for every little expense in your business?

- If you’re curious whether your information are acceptable, take a look at Keeper’s guide to enterprise receipts.

- Work-related expenses are a crucial a half of running a successful business, and as a self-employed individual, you can deduct many of these bills in your tax return.

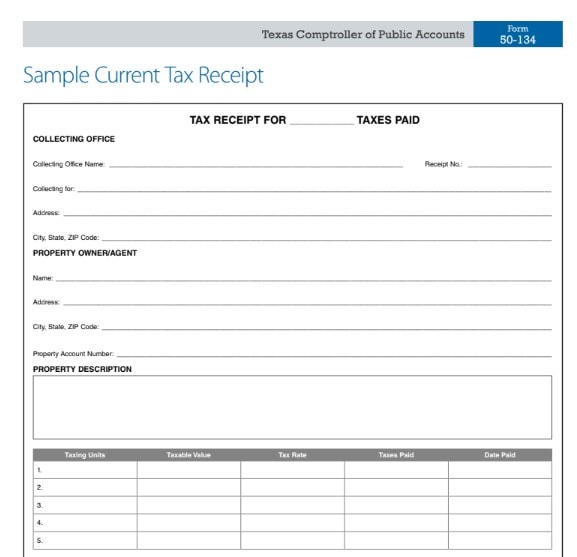

- Supporting documents embody gross sales slips, paid payments, invoices, receipts, deposit slips, and canceled checks.

- These information not solely contribute to the sustainability and effectivity of your personal home but in addition offer tangible advantages in phrases of cost financial savings and property worth.

Medical Expense Receipts

For instance, if you’re a business proprietor, you should hold all receipts for bills associated to overnight lodging. If you’re deducting journey bills associated to medical remedy, then you could want to label your travel receipts with some notes in regards to the remedy and where you obtained it. If you’ve never itemized deductions, you would possibly imagine that you should connect receipts to your tax forms. In fact, that’s not the case, but you should maintain receipts for any private or enterprise transactions associated to the deductions you’re taking. At WorkMoney, we companion with organizations like Rewiring America and EnergySage, which might help you find ways to chop utility prices and estimate credits and deductions at tax time. If you itemize deductions and you understand you need to pay for work-related bills, you should begin saving these receipts.

How To Determine On A Trusted Tax Preparer Avoid Refund Scams

These receipts might be important for tax purposes and potential future sales of your house. These data contribute to the general management of your home’s belongings and may be advantageous for future upkeep, insurance claims, and monetary planning. When you sell any business property — similar to the real property, furniture or equipment you utilize — you’ll need to hold the acquisition and sales agreements in addition to your receipts. You’ll also want the purchase receipts if you use depreciation on your business assets as tax write-offs. Whichever route you’re taking, be positive to know the means to save and arrange receipts for taxes — the final thing you want is to not have the documents you need to defend your self during an IRS audit. You must be organized in order to save all your deductible receipts in one place.

You will likely pay a charge for this service, however it’s a small price to keep your personal what type of receipts to save for taxes information protected. Health insurance policies and associated paperwork are necessary to maintain long run, too. So long as your medical insurance is energetic, you must keep these information. If your coverage ended or you’ve moved to a different insurance firm, go ahead and toss paperwork once you’re positive you won’t want it. The identical is true should you obtain incapacity or unemployment advantages. You can toss most month-to-month bills after you pay them, or after the funds have credited to your financial institution assertion.

First, we suggest making notes on receipts if the deductible nature of the expense just isn’t clear. Jotting down the attendees’ names and the meal’s objective on the back of the receipt will ensure that you have the information you want. We recommend saving all business receipts related to your self-employment as a end result of many of those expenses are likely to be tax deductible. The self-employed have additional tax obligations as a outcome of they want to pay both the worker’s and the employer’s portion of Medicare and Social Security taxes. Nonetheless, many expenses related to self-employment are deductible, together with the following. Right Here are the medical bills you might deduct and due to this fact, want receipts as proof of fee.

For example, utility and telephone invoice amounts are generally the identical amounts every month. If you’re off by a few https://www.kelleysbookkeeping.com/ dollars in your estimate, it won’t considerably sway your tax calculation. The CRA will often settle for an estimate to fill a niche in your receipts, especially if you’re only lacking one out of many receipts for a recurring cost. If you misplaced a receipt or forgot to avoid wasting one, don’t panic, you have choices.